February 9, 2025

The Best Free Debt Payoff Spreadsheets for 2024

In this guide we'll break down budgeting basics and popular debt payoff strategies, then show you how to leverage the power of free, downloadable spreadsheets to track your progress. Whether you're a spreadsheet pro or a tech newbie, there's a tool here to fit your style. Get ready for some strategies to pay down debt and start building a brighter financial future.

The Best Free Spreadsheets for Paying Down Debt

Mastering Debt Management: Comprehensive Tools and Strategies

Embarking on the path to financial freedom can feel daunting, especially when multiple debts cast shadows on your journey. The good news is there are tools that can help guide your way. One of the most important tools being spreadsheets. At first spreadsheets may seem intimidating, but in this case technology is your friend. These spreadsheets are designed towards debt management and can automatically track your cash inflow and payments, allowing you to focus on the big picture. But before diving into the utility of these spreadsheets, let's arm you with some foundational strategies.

Essential Steps to Streamlining Your Debt Payment Process

1. Understand Your Budgeting Fundamentals:

Before tackling debt, it's paramount to grasp your financial inflow and outflow. Begin by listing all your expenses on a spreadsheet and comparing them against your income.

Focus first on unavoidable expenses, such as groceries, utilities, rent, insurance, and transportation. Tools like Mint's monthly budget template can be invaluable here. They often have predefined categories that help you segment and understand your expenditures better.

Keep in mind that budgeting preferences vary. Some might prefer a granular breakdown, like the personal monthly budget template by Vertex42 that dissects entertainment costs into niches like sports or theatre. Your goal is to choose a format aligning with your comfort level, ultimately helping you discern your earnings, essential spending, and what's left.

2. Strategize Your Debt Payment Approach:

With your surplus identified, you're in a better position to address your debts. Two popular strategies dominate this space:

- Snowball Method: Focus on clearing debts with the smallest balances first. It provides a psychological win, motivating you to tackle bigger debts subsequently.

- Avalanche Method: Prioritize debts with the highest interest rates. This approach minimizes the amount paid overtime.

Regardless of the approach, maintaining minimum payments on all accounts is essential to avoid penalties.

3. Embrace the Right Debt Payoff Spreadsheet:

With your budget and strategy in place, it's time to harness the power of specialized spreadsheets. These tools, such as “credit card payoff spreadsheets” or “student loan spreadsheets,” not only track your balances and interest rates but also calculate your remaining payments. The variations among these tools often lie in their organizational structure and sophistication level. For instance, some might project a payment timeline based on your chosen strategy.

Discover the Best Free Debt Payoff Spreadsheets:

Spreadsheets have emerged as game-changers in the debt management landscape, and the digital realm offers a plethora of them, free of charge. At RISE, we've curated some of the best, tailored towards the different debt scenarios you may be facing. You can download all these spreadsheets for free online and input your own debt numbers with programs like Microsoft Excel or Google Sheets.

1. Vertex42 Debt Reduction Spreadsheet

Features:

• Lists out multiple types of debts, from credit cards to mortgages.

• Provides a summary graph to visualize your debt reduction journey.

• Supports different payment strategies, such as the Snowball or Avalanche method.

What We Like: Vertex42's spreadsheet is user-friendly and offers clear visualization, making it an excellent choice for our borrowers, especially if you're just starting out.

2. Google Sheets Debt Snowball Calculator

Features:

- Intuitive design and layout.

- Emphasizes the Snowball method – paying off smaller debts first.

- Auto-updates as you input payments.

What We Like: With Google Sheets, it's accessible anywhere, shareable, and doesn’t require any software installations. Ideal for our tech-savvy borrowers!

3. Spreadsheet123 Debt Reduction Calculator

Features:

• Detailed debt summary table.

• Potential interest savings projections.

• Payment schedules for consistent tracking.

What We Like: Spreadsheet123 provides a panoramic view of all your debts, interest rates, and gives you a clear roadmap.

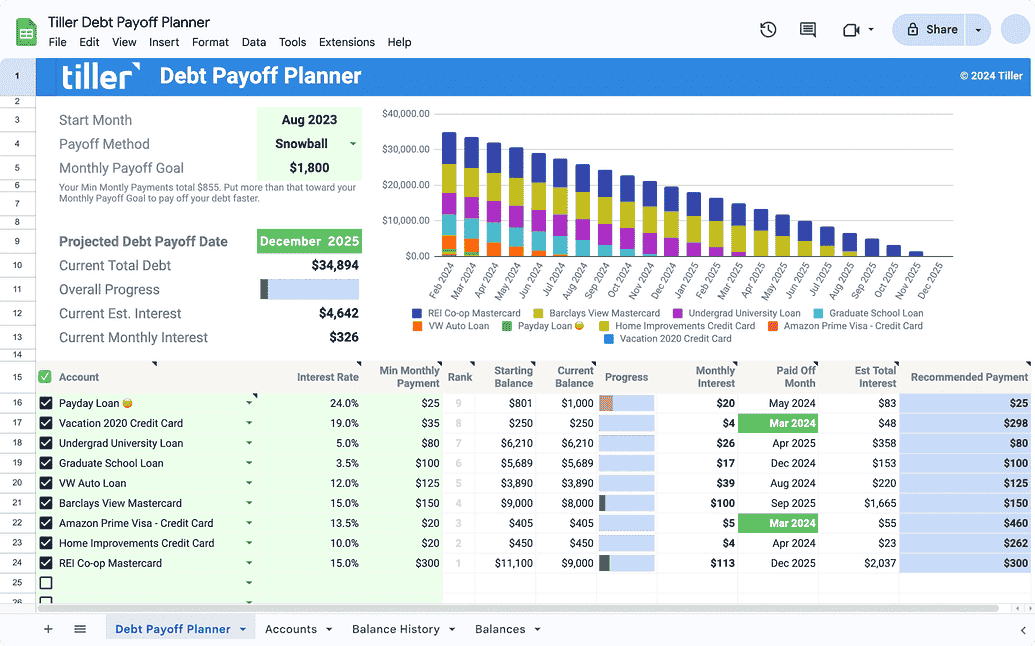

4. Tiller Money’s Debt Planner Spreadsheet

Features:

• Features automated updates when linked to bank accounts.

• Detailed overview including interest and payment details.

• Tailored debt payoff plan.

What We Like: Tiller Money minimizes manual data entry, ensuring that borrowers always have an updated view of their finances.

5. Healthy Wealthy Skinny Debt Tracker

Features

- Simple yet still has what you need to pay off debt.

- Uses the debt snowball method.

- Available for both Excel and Google Docs

What We Like: Looking for simplicity? This minimalist debt spreadsheet has everything you need to track, manage, and pay down your debt without the frills and complicated math.

6. Squawkfox Debt Tracker Spreadsheet

Features:

- Load, sort, and track your debt in a structured manner.

- Populates graphs for a visual representation of your debt repayment.

What We Like:

The Squawkfox Debt Tracker offers a visual twist on the traditional spreadsheet. For those who prefer graphical representation, this tool provides an intuitive way to see and understand the progression of your debt repayment journey.

If you’re struggling with debt reduction and you’re looking for more resources on how to regain your financial foothold, check out our resources, such as how to build a budget, how to rebuild credit quickly, and how to build good spending habits.

RISEcredit.com offers online personal loans, helping you to get the money you need when you need it most. But RISE is more than just a loan, we’re here to help you on your path to a brighter financial future. RISE offers features like flexible payment options, free credit monitoring, and reports to major credit bureaus - so consistent and on-time payments may help you build your credit. If you’re in the market for a loan, or just want to learn more about RISE, visit RISEcredit.com today.

Trending Articles

January 31, 2025

February 6, 2024

May 31, 2023