December 27, 2023

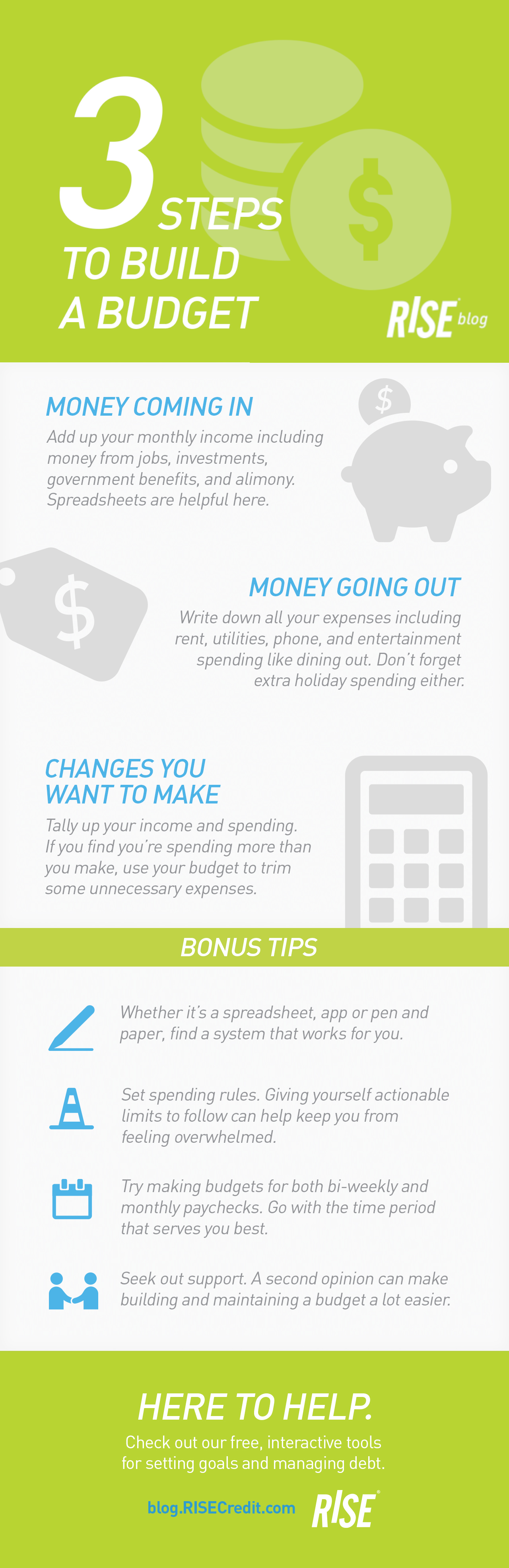

How to Build a Budget in 3 Easy Steps

Creating a budget is often the first step on the road to financial freedom. It sounds easy in theory, but in practice can be complicated with various tools and approaches to consider. How do you build a budget quickly so you can get started reaping the benefits right away? We've got a fuss-free, three-step solution for you.

Step 1: What money is coming in? Income

Start by adding up your monthly income. (A spreadsheet could come in handy for this type of tracking.) Be sure to include all income sources, including money coming in from jobs, investments, alimony and government benefits.

Income should be calculated on a net basis, meaning the money you take home after all deductions for items like taxes and 401(k) contributions.

Step 2: What money is going out? Spending

Next, write down all your expenses. This includes your rent or mortgage payment, utilities such as gas, electric, phone and internet, plus the money you spend on groceries, dining out, gym memberships and child care.

Your expenses should also include payments toward debts, such as credit cards, student loans and car loans. During holiday months, don’t forget about expenses for gifts, decorations and special events.

Step 3: What changes do you want to make? Tracking and adjustments

Tally up your income and spending. If your monthly income is greater than your expenses, congratulations! You have extra money to dedicate toward a financial goal, like saving for a home, paying down debt or building a retirement fund.

If you’re like many Americans, your budget may show you you’re spending more than you’re taking in. Use your budget to see exactly where you could trim some expenses (maybe eating out less frequently) or bolster your income (perhaps taking on an extra shift at work each month).

Extra budget tips

Everyone has their own tips and tricks for creating a budget and sticking to it. Here are a few of our favorites:

- Find a system that works for you. Some people like spreadsheets, while others prefer smartphone apps or even old-fashioned pen and paper. Keep experimenting until you find a method that works well for you.

- Create your own customized “money rules.” Make a unique promise to yourself, such as, “I will keep my spending on discretionary items to a maximum of $40 per week.” Small, actionable steps can help keep you from feeling overwhelmed.

- Experiment with different time periods. Would you prefer to budget for each bi-weekly paycheck? Try it! There’s no reason to stick to a monthly cycle if it doesn’t serve you well.

- Seek out support. Try bringing your spouse, partner and/or children on board with your financial goals. With their support, it can be easier to build and maintain a budget.

A budget is a powerful tool to set priorities, achieve goals and build a solid foundation for your financial future. If you’re working to build better money habits, RISE is here to help. Check out our free, interactive tools for setting savings goals and managing debt.